Service Now SAM pro

Is Your ServiceNow SAM Pro Investment Falling Short?

Do you lack qualified internal resources and struggle to find experienced, certified, and cost-efficient SAM Pro resources? You're not alone! Many organizations find it challenging to unlock the full potential of their SAM Pro setup, but that’s where LDS can help. We can transform your SAM strategy and deliver a 10x return on your investment.

Our ServiceNow SAM Pro Managed Services can help you:

- Improve Data Quality – Ensure your software entitlements and deployment data are accurate and reliable.

- Optimize Your License Compliance (ELP) – Stay compliant while minimizing unnecessary licensing costs.

- Boost Tool Performance – Enhance your SAM tools for greater efficiency and productivity.

- Enhance CMDB Maturity – Build a more robust Configuration Management Database (CMDB).

- Leverage SaaS/FinOps Reporting – Gain actionable insights that lead to significant cost savings.

Why Choose LDS?

Headquartered in the heart of New York City, Licensing Data Solutions (LDS) is dedicated to optimizing SAM Pro environments through routine health checks, contract management, and delivering precise, defendable license position reports. Our expertise helps organizations achieve best-practice ITAM governance and unlock real ROI from their SAM Pro investments.

Are you open to a quick chat about optimizing your ServiceNow SAM Pro setup? Let me know a good time!

Maximizing Your ServiceNow SAM Pro ROI

Are you having difficulty realizing the full value of your ServiceNow SAM Pro investment? Do you lack qualified internal resources and struggle to find experienced, certified, and cost-efficient SAM Pro resources? You're not alone! Many organizations find it challenging to unlock the full potential of their SAM Pro setup, but that’s where LDS can help. We can transform your SAM strategy and deliver a 10x return on your investment.

At Licensing Data Solutions (LDS), we help companies like yours maximize their SAM Pro ROI. Our managed services focus on improving data quality, optimizing license compliance, boosting tool performance, enhancing CMDB maturity, and leveraging SaaS/FinOps reporting for significant cost savings.

As a ServiceNow Partner with a team of 40 former software licensing auditors and certified SAM Pro professionals, we have a deep understanding of software compliance, IT renewals, and procurement. We provide routine health checks, contract management, and precise license position reports to ensure best-practice ITAM governance.

Would you be open to a brief chat to discuss how LDS can help you optimize your ServiceNow SAM Pro setup and achieve a 10x return on your investment?

RISE with SAP Demystified: Costs, Contracts, BOM, Key Features, Limitations and Key Considerations

Table of Contents

What is ServiceNow Software Asset Management Professional (SAMPro), and What is the Difference Between Foundation and Pro/Enterprise?

Mastering Oracle ULAs: Dispelling Myths and Managing Certification Successfully in 2026

Table of Content

Introduction

VMware's Drastic Switch From Processor to Core Licensing 2026: Potential for a 5X-40X Surge in Your VMware Software spend

Table of Contents

- Introduction

- Unpacking VMware’s New Licensing Model

- What is a Core?

- How Does VMware Define Core?

- Core-Based Licensing vs. Processor-Based Licensing

- Subscription-Based Model

- Minimum License Capacity (16 Cores per CPU)

- Calculation of Capacity Required

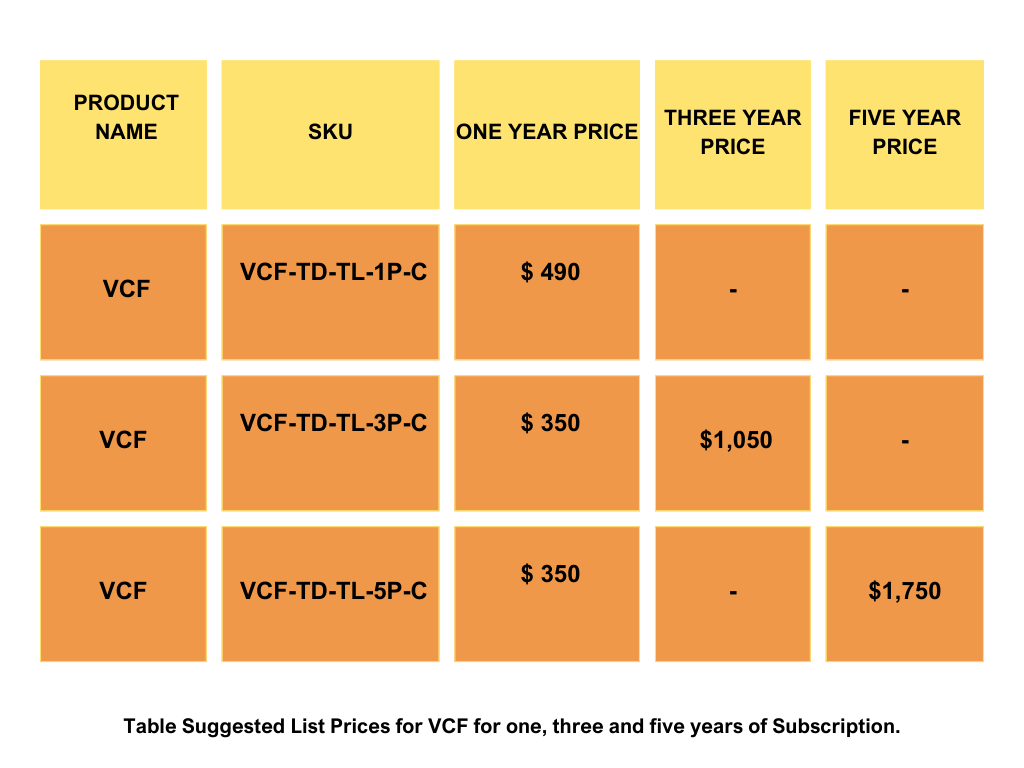

- Analysis of VCF Pricing (1-5 Years)

- Analysis of VVF Pricing (1-5 Years)

- vSAN Included With VCF and VVF Bundles

- What is a Tebibyte (TiB)?

- Difference Between TiB, GiB, TB, GB

- VVF and VCF With vSAN Capacity Table

- LDS Recommendations

- Conclusion

Introduction

Following Broadcom's acquisition, significant changes have been introduced. These include discontinuing the sale of all perpetual licenses in favor of a subscription-based model, modifications to packaging and bundling of vSphere, vSAM to VCF and VVF, and a transition from processor to core-based licensing. Collectively, these changes are forming a substantial challenge, leading to customers experiencing shocking increases in costs ranging from 5-40X their current spending. This blog will specifically concentrate on the shift from processor to core licensing and provide essential information to help you understand and mitigate the impact of this change.

Unpacking VMware’s New Licensing Model

What is Core?

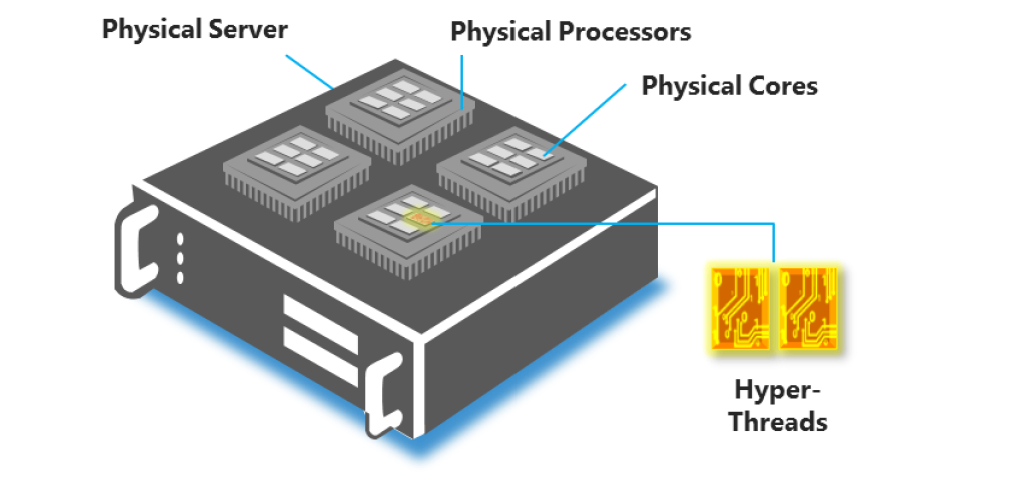

A core is an individual processing unit within a Central Processing Unit (CPU). It functions as the "brain" of the CPU, receiving instructions and executing calculations or operations to fulfill those instructions. A CPU may contain multiple cores, each capable of operating independently from the others.

Physical server showing physical processors, physical cores, and hardware threads

Physical server showing physical processors, physical cores, and hardware threads

How Does VMware Define Core?

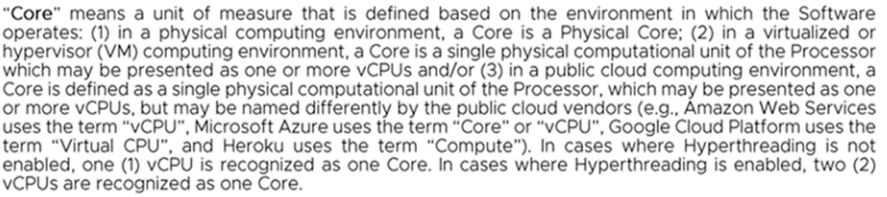

“Core” means a unit of measurement that is defined based on the environment in which the Software operates:

- in a physical computing environment, a Core is a Physical Core;

- in a virtualized or hypervisor (VM) computing environment, a Core is a single physical computational unit of the Processor which may be presented as one or more vCPUs and/or

- in a public cloud computing environment, a Core is defined as a single physical computational unit of the Processor, which may be presented as one or more vCPUs, but may be named differently by the public cloud vendors (e.g., Amazon Web Services uses the term “vCPU”, Microsoft Azure uses the term “Core” or “vCPU”, Google Cloud Platform uses the term “Virtual CPU”, and Heroku uses the term “Compute”).

- In cases where Hyperthreading is not enabled, one (1) vCPU is recognized as one Core. In cases where Hyperthreading is enabled, two (2) vCPUs are recognized as one Core.

VMware, After Getting Acquired by Broadcom, Changed Its Licensing Model From Processor to Core.

Adding to the complexity, VMware has transitioned to a new licensing model based on the number of cores in a Processor rather than the previous model, which was based on the number of processors.

Let’s break down how it works:

Subscription-Based: The core-based licensing model is subscription-based “Only.” This means you pay a recurring fee to use the software, for example, on a rental basis.

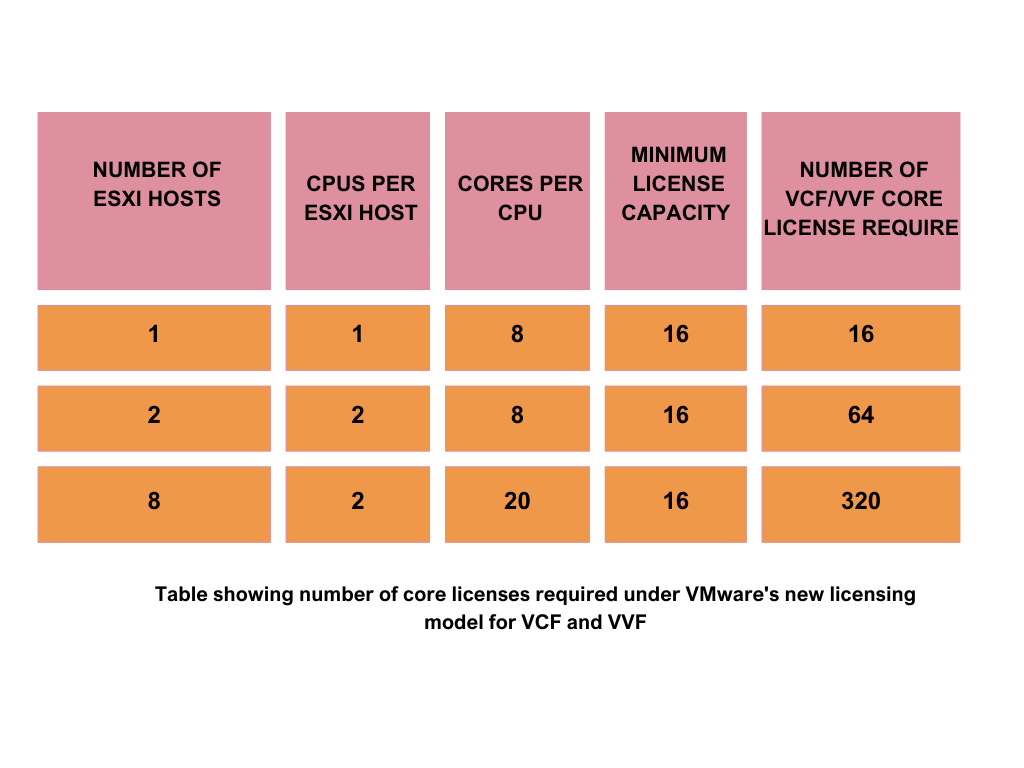

Minimum License Capacity: For VVF and VCF, customers must purchase a minimum license capacity of 16 cores per CPU. This means that even if your processors each have fewer than 16 cores, you’ll pay for 16 cores anyway.

Calculation of Capacity: To calculate the capacity needed for your environment, you need the total number of physical cores for each CPU on all ESXi hosts individually in your environment and then sum it up.

Example: To illustrate, suppose you have a single ESXi host in your inventory with a single CPU that has 8 cores. In this case, you are required to buy a subscription capacity for 16 cores per CPU, as this is the least license capacity available. If you have two ESXi hosts, each with two CPUs and each CPU having 8 cores, you would require a total of 64 core licenses.

VSAN Capacity Now Comes Bundled With VMware Cloud Foundation (VCF) and VMware vSphere Foundation (VVF)

vSAN capacity is now included in the VMware Cloud Foundation (VCF) and VMware vSphere Foundation (VVF) bundles. vSAN, which is a storage solution, is integrated with vSphere and managed through a single platform.

For VMware Cloud Foundation (VCF), the licensing model stipulates that each core license bought provides 1 Tebibyte (TiB) of vSAN capacity.

In the VMware vSphere Foundation (VVF) case, the licensing model grants 100 Gibibytes (GiB) of vSAN capacity for each core license purchased.

Additional capacity used must be purchased using the Add-on SKU.

vSAN TiB Licensing Metric

VMware’s vSAN, a software-defined storage solution, employs a distinctive licensing metric based on tebibytes (TiB). This metric considers the total usable capacity of your vSAN datastore, quantified in TiBs.

What is a TiB?

A tebibyte (TiB) is a unit of digital storage equal to 2^40 bytes, which is roughly 1.1 times the size of a traditional terabyte (TB) based on a power of 10. TiB (Tebibyte) is a different unit to a TB (Terabyte) commonly used for storage. While they sound similar, a TiB is actually about 10% larger than a TB. This seemingly small difference translates to a significant distinction in licensing costs.

Difference between Tib, GiB and TB, GB:

Table showing number of TiB licenses required for vSAN under VMware new licensing model.

Overall, VCF is advantageous if you are utilizing VSAN or considering its use in the future.

Broadcom is offering VSAN at no cost as part of a bundle to encourage customer adoption/addiction to VSAN and other included products.

LDS Recommendations:

Assess the New Consumption Metrics by Conducting an Effective License Positioning (ELP)

VMware Enterprise License Position will clearly illustrate the consumption levels under both the old and new models and demonstrate the cost implications of each.

Optimize and Right Size Deployments Before Renewal to Reduce Renewal Cost

The era of deploying vSphere without careful planning has passed. Developing a proactive approach to managing your resources efficiently by creating an Enterprise License Position is essential. This strategy ensures that you only invest in what is necessary, reducing future renewal expenses.

Do Not Run Any Scripts or Provide Outputs to VMware/Broadcom Sales Reps

Do not run any scripts or provide data as requested by Broadcom sales representatives. Specially Counting Cores for VMware Cloud Foundation and vSphere Foundation and TiBs for vSAN (95927). Be aware that this could be a stealth backdoor attempt to audit your VMware deployments. Executing these scripts and sharing the outputs with Broadcom has led to some customers facing unexpectedly high charges, often 10 to 40 times their usual costs. To safeguard your interests, it is critical to have any script outputs independently analyzed by a third party, then prioritize cleaning up and optimizing your environments and only share the most essential, high-level data with Broadcom for renewal purposes.

This cautious approach will help protect your business from potential financial pitfalls and any internal embarrassment after VMware sends an inflated bill to your senior management.

Negotiate with VMware, recognizing that you are dealing with an entirely new vendor:

a. Begin preparation and negotiations at least 6-8 months in advance.

b. Analyze current demand, consumption, and project future costs.

c. Benchmark your pricing; previous VMware pricing and discounts may no longer be applicable.

d. Be prepared for rigorous negotiations to maintain the terms of existing contracts, as Broadcom has shown reluctance to honor them.

e. Expect extensive negotiations if you intend to obtain credits for old perpetual licenses.

f. Involve C-level executives or senior management in discussions with VMware, as renewals are no longer straightforward processes that can be handled solely by the Infrastructure team. Broadcom is likely to rapidly escalate issues to your top executives.

Conclusion

Given the complex nature of these issues, if you lack the necessary in-house expertise or need assistance explaining these changes to your management, don't hesitate to contact Licensing Data Solutions. A thorough grasp of VMware's products and their uses can be obtained through an Effective License Position (ELP) analysis. It's important to understand the possible outcomes, including higher costs, more complicated management, and less flexibility and control. For the best and most effective ELP analysis, consider working with Licensing Data Solutions (LDS). Feel free to reach out for advice at This email address is being protected from spambots. You need JavaScript enabled to view it..

Licensing Data Solutions(LDS) is a leading provider of Audit Defense, Software Asset Managed Services , SaaS and Cloud FinOps Cost Saving Analysis, for major software vendors such as IBM, SAP, Microsoft, Oracle, Quest, Autodesk, VMware, Salesforce, and ServiceNow. Our team of 35 analysts comprises former software compliance auditors with expertise in delivering exceptional services. At LDS, our clients benefit from cost savings of up to 30 percent on their software spend and up to 85 percent on their audit findings.

Also read more on this:

Please check our VMware Licensing Services

Introduction

On November 22, 2023, Broadcom made a significant impact on the IT industry by acquiring VMware for $69 billion, one of the most substantial technology transactions to date. Immediately after the acquisition was finalized, Broadcom quickly introduced significant alterations to the licensing model by ending perpetual licensing and major changes to the partner network, including how customers interact with resellers and Broadcom, as well as changes to the product packaging and bundling. This blog will cover these changes in detail, examining their effects on you as a customer. We will also provide advice on steps you can take to safeguard yourself and minimize the impact on your budgeting and licensing strategies.

Change 1 - VMware Ends Perpetual Licenses and Introduces Subscription Licensing

On December 11, 2023, VMware, now a subsidiary of Broadcom, announced a pivotal alteration in is licensing strategy, ceasing the sale of new perpetual licenses. Henceforth, VMware software will be exclusively accessible via subscription models. To clarify this change, the subscription tmodel may be compared to renting a residence or leasing a car; the license is not owned, yet it remains usable as long as the subscription fees are continually paid. Conversely, a perpetual license resembles the outright purchase of a residence or automobile; the license is owned indefinitely, with typically only nominal maintenance fees required in subsequent years. This shift towards subscription models is a trend increasingly adopted by software companies in recent years. However, Broadcom's decision to suddenly entirely eliminate perpetual licenses and forbid any new perpetual acquisitions has been met with disappointment and dismay among customers.

Please see the link to the official announcement below:

https://news.vmware.com/company/vmware-by-broadcom-business-transformation

VMware Perpetual License Phase-Out: Implications for Existing Customers

Shock at Contract Expiration and Forced Migration:

Clients currently engaged in an Enterprise License Agreement (ELA) or possessing active maintenance agreements will not experience immediate impacts from this change. They are permitted to utilize their perpetual licenses until the conclusion of their agreement or the expiration of their maintenance period.

Upon the termination of an ELA or active maintenance agreement, clients will be ineligible to receive future maintenance for their existing licenses under the old model, necessitating a forced transition to VMware’s subscription-based offerings.

Furthermore, should there be a requirement to procure any new products not encompassed within the ELA or existing agreements during the term of an ELA, such acquisitions must be made under the newly established subscription model.

Escalating Cost at Renewal

This evolution is advantageous for customers who favor operational expenditure (Opex) for their purchases. However, it poses challenges for those who prefer capital expenditure (Capex) strategies, aiming for significant upfront investment followed by reduced operational costs, and for customers who are using VMware software without active maintenance.

Customers of VMware are likely to experience an increase in costs upon renewal. This escalation can be attributed to the potential forfeiture of their existing investment in perpetual licenses. Despite assurances from Broadcom regarding the availability of a trade-up path, it has not demonstrated cost neutrality. Additionally, customers may encounter a progressive increase in expenses over time, as the subscription model tends to be more costly in the long term.

Strategic Recommendations to Customers

Understand That the Landscape Has Changed for Good

It is imperative for customers to recognize that the acquisition of VMware by Broadcom has fundamentally altered the operational landscape. The prevailing paradigms have undergone a significant shift, rendering the former status quo with VMware untenable. Clients must initiate their preparatory measures promptly, adopting a strategic approach akin to that utilized in negotiations with Microsoft or Oracle.

Understand Usage and Simulate Cost and Quantity Under the New Subscription Model

Carry out a detailed review of your current usage against what you have purchased. This evaluation, called the Enterprise License Position, gives a clear picture of how you are using VMware resources compared to what you have bought. It helps in understanding your current usage, as well as estimating future usage, if you switch to a subscription model. Based on this assessment, it is advisable for customers to adjust their deployments to prevent an unexpected rise in costs.

Change 2 - Broadcom Major Changes to the Reseller/Partner Network

Furthermore, alongside the transition from perpetual licensing to subscription-based models, Broadcom has implemented substantial modifications to its partner/reseller network. These changes could significantly alter your interactions with VMware.

Broadcom's Strategic Shift in Eliminating Resellers for Strategic Accounts: Broadcom has initiated a notable strategic shift by opting to directly oversee its major VMware accounts (2000 as per unofficial estimates), diverging from its prior approach. This repositions partners, who played a crucial role in the management of these accounts, to a sidelined status. Broadcom is now designating substantial accounts as Strategic Accounts, and will engage with them directly. Consequently, entities recognized as Strategic Accounts will no longer have the liberty to procure through their resellers, but will instead be obligated to conduct transactions directly with Broadcom.

Narrowing of Reseller Network: Broadcom has decided to reduce the number of its resellers, especially eliminating small ones. This change will greatly affect smaller businesses because they will no longer be able to sell Broadcom products through their current reseller. They will need to find and work with a larger reseller instead.

Consequences of Partner Alterations for Customers:

Direct Interaction With Broadcom and Increase in Cost: Broadcom is making changes that will reduce the support and incentives previously provided by resellers, especially for large or strategic accounts. This means that instead of receiving personalized support from resellers, these accounts will have to deal directly with Broadcom. This shift could result in the loss of discounts due to Broadcom's tough negotiating stance. Moreover, without a reseller acting as an intermediary, there's a higher chance of audits. If Broadcom's sales staff finds the terms of a deal unsatisfactory or decides to examine an account closely, they may be more likely to nominate the customer for a software licensing audit.

For smaller customers, this adjustment will likely lead to increased costs, as they will now need to engage with larger resellers. These bigger entities may not place as much emphasis on their relationship or exert the same effort to secure discounts that smaller resellers previously managed to obtain.

Guidance for Customers on How to Navigate This Reseller Change:

For small customers, verify whether your current reseller remains within the Broadcom network. If not, initiate efforts to build connections with a reputable reseller.

For large customers, prepare for direct negotiations with Broadcom. Begin preparations for VMware/Broadcom discussions several months prior to your contract's expiration. Consider enlisting third-party assistance, such as LDS, which can aid in comprehending the alterations, educating your internal management, analyzing your current and future consumption and costs, benchmarking these costs, and facilitating negotiation and adaptation to this new standard.

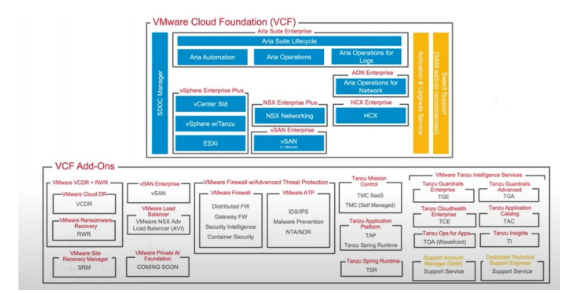

Change 3 - VMware Draconian Product Packaging/Bundling Changes!

In conjunction with the transition from perpetual licensing to subscription models and the consolidation of resellers and partners, a significant simplification and consolidation in product packaging was also unveiled. The array of stock-keeping units (SKUs) has been streamlined, resulting in the reduction to four primary SKUs: 1) VMware Cloud Foundation, 2) VMware vSphere Foundation, 3) VMware Standard, and 4) VMware Essentials.

Let’s delve into the landscape of VMware’s product offerings:

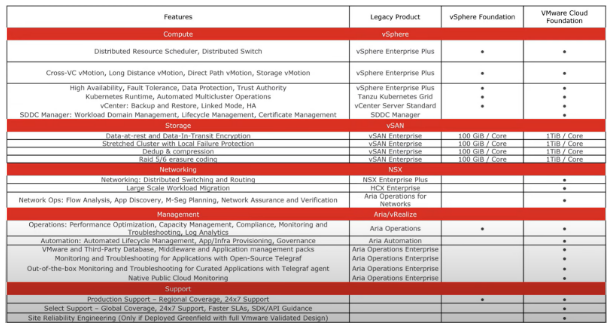

- VMware Cloud Foundation (VCF):

- vSphere Enterprise Plus

- vSAN Enterprise (1TiB per core) Not to be confused with TB (TeraByte) which is a different metric

- Tanzu Kubernetes Grid

- SDDC Manager

- HCX Enterprise

- NSX Enterprise Plus

- Aria Operations

- Aria Automation

- Aria Operations Enterprise

- Select Support

- Site Reliability Engineering

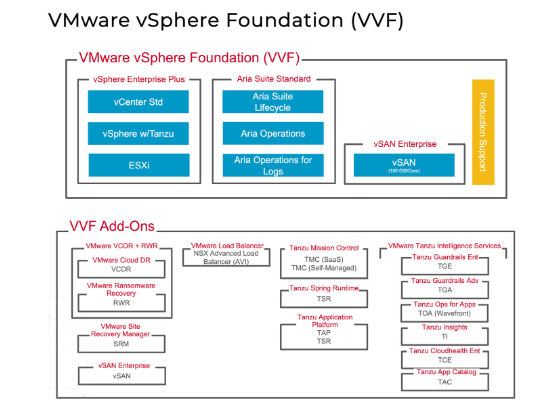

- VMware vSphere Foundation (VVF):

- vSphere Enterprise Plus

- vSAN Enterprise (100 GiB per core) Not to be confused with GegaByte GB

- Tanzu Kubernetes Grid

- Aria Operations

Feature difference between VCF and VVF

- vSphere Standard

- vSphere Standard

- vCenter Standard

- vSphere Essential Plus Kit

- vSphere Essentials

- vCenter Essentials Plus

- Limitations

- Maximum of 3 hosts w/up to 96 Cores

Perspectives on the Recent Packaging Changes:

- This transformation is favorable for individuals fully committed to utilizing VMware; however, it poses disadvantages for customers who do not employ the complete suite of products, such as Aria/NSX.

- The implementation of product bundling is anticipated to lead to a price augmentation ranging from two to five times for all customers, attributable to the financial implications of acquiring these bundles.

- The bundling strategy is likely to culminate in the underutilization of software, resulting in resources being expended on unused software.

- VMware aims to incentivize customers to adopt more products from its suite, potentially altering bundle offerings or introducing premium versions of these products in the future to extract additional revenue from clients.

LDS Recommendations in Handling This Product Bundling

Comprehend Actual Utilization and Project Future Consumption: Clients are encouraged to ascertain both their present and anticipated future utilization at the SKU level, and to conduct a comparative analysis of current versus future costs. Leveraging this analysis, customers should negotiate discounts with VMware/Broadcom.

Elevate This Matter to the Level of Executive Management: VMware renewal is no longer a task the infrastructure team can manage on its own. Comprehending the alterations and devising either a temporary or prolonged strategy now requires the attention and decision-making of either the Chief Information Officer (CIO) or another high-ranking executive.

Investigate Substitute Strategies: It is advisable to examine other virtualization solutions that may present a more economical option, especially those characterized by stable pricing structures and negligible concealed expenses. Furthermore, it is anticipated that the future will be marked by escalating prices, a decline in development and customer support, intensified sales representative tactics, and rigorous software compliance audits.

In discussions with our clientele, the following alternatives have been mentioned:

- Transitioning to cloud services such as Azure, AWS, or GCP

- Exploring Microsoft Hyper-V

- Evaluating Nautanix

- Exploring Verge.io

- Investigating Proxmox

- Transitioning to Physical Servers

Engage in Strategic Negotiations: Upon subscription renewal, it is advisable to enter into assertive negotiations with VMware to uncover possible concessions. Benchmark your agreement to ascertain the standard discounts currently provided by Broadcom and recognize the shift in dynamics as you are now interacting with a representative from Broadcom, rather than the familiar VMware representative.

Conclusion

In summary, Broadcom has implemented significant alterations to VMware's packaging, licensing model, and reseller network. These changes are poised to deeply affect your association with VMware. It is advisable for clients to recognize that the operating framework has fundamentally transformed and to take the necessary measures to comprehend their usage, and to prepare for extensive and forceful negotiations with VMware. Additionally, it is imperative for this matter to be escalated to the level of Chief Information Officer (CIO) and to devise a strategy for assessing alternative Hypervisor Technologies. Should there be a lack of expertise internally, or a requirement for an external consultant to provide enlightenment on these modifications, assess your actual usage, project your future VMware cost, and explore alternative options, then please do not hesitate to contact Mark Thaver at This email address is being protected from spambots. You need JavaScript enabled to view it..

Please check our VMware Licensing Services

More...

2026 Expert Guide to Oracle VirtualBox Licensing: Navigating Free and Paid Editions for Businesses and Effectively Addressing Oracle Sales Inquiries

It is imperative for businesses to thoroughly grasp the complexities involved in the licensing of Oracle VM VirtualBox, a product ingeniously designed to draw in users with its freely accessible downloads and initial no-cost use cases while harboring intricate stipulations and speed traps for corporate use. Oracle employs a distinct and assertive sales methodology for this product, focusing heavily on compliance. The licensing intricacies of Oracle VM VirtualBox, marked by their complexity and potential pitfalls, necessitate a precise understanding and strict adherence by businesses to avoid significant financial repercussions. This article delves into the nuances of the licensing processes with a particular focus on the critical distinctions between free and paid licenses. The information presented is pertinent not only to individual users for personal projects, but also to organizations operating on a more expansive scale.

What is Oracle VirtualBox?

Oracle VirtualBox is a program that lets you run several different operating systems on one computer. You can install it on computers with Intel or AMD processors that use Windows, macOS, Linux, or Oracle Solaris. With VirtualBox, you can set up several virtual machines, and each one can run its own operating system, separate from the computer's central system. This is especially useful for software developers who need to test their programs on various operating systems, and for security professionals who want to check applications in a safe, separate space.

What is the Licensing Model for Oracle Virtual Box?

Oracle VirtualBox has two main types of licenses:

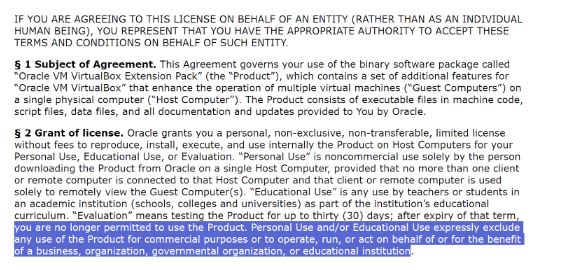

Open-Source GNU General Public License (GPL) Version 2: This is for the basic version of VirtualBox. It's free for anyone, including individuals and businesses. You can download, use, and change the software without paying. If you share a version of VirtualBox that you've modified, you must also share it for free under this same license.

Personal Use and Evaluation License (PUEL): This license is for the Oracle VM VirtualBox Extension Pack, which adds extra features like support for USB 2.0 and 3.0, VirtualBox RDP, disk encryption, and NVMe. You can use this for free if it's for personal use or trial it for 30 days, however, if you're using it in a business or for commercial purposes then you must first purchase a license. The PUEL is not open source, meaning you can't freely distribute or modify the Extension Pack.

For more detailed information on the VirtualBox Personal Use and Evaluation License (PUEL), you can visit the official VirtualBox PUEL page.

Snippet from PULE Commercial Use fine print restriction

https://www.virtualbox.org/wiki/VirtualBox_PUEL

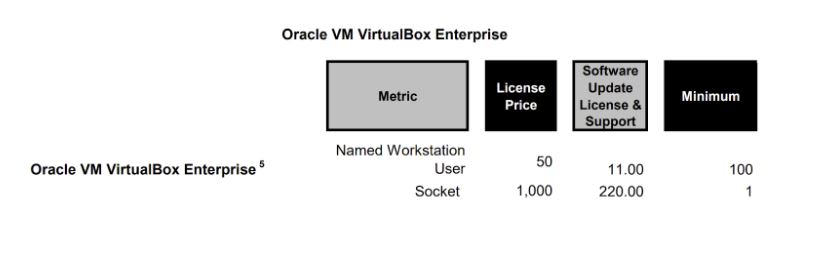

Oracle VM VirtualBox License Pricing Models & Costs

We've broken down the cost and types of pricing for Oracle VM VirtualBox and given some examples to show how this might affect companies thinking about using Oracle VM VirtualBox. Oracle offers VirtualBox through a traditional license and maintenance payment method. There are two main ways to pay for it: based on the number of individual users (Named Workstation User) or each CPU socket in the servers (per Socket licensing). The Named Workstation User option is better when each person using VirtualBox is known and has their own set up. The per Socket option works best for server setups where VirtualBox runs on physical servers that have one or more CPU sockets. Now let’s review each of these licensing models in detail.

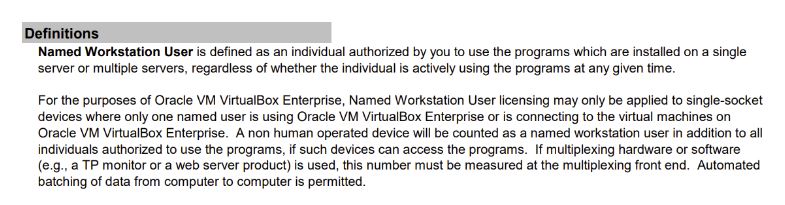

Named Workstation User

This pricing plan is for specific people or individual users in a company. Every person who uses the software, whether directly or not, needs to have a license. However, you can't buy just a few licenses; the minimum number you have to buy is 100. For each person using the software (each Named User), it costs $50, and there's an additional $11 per year for support.

From Oracle

Named Workstation User is defined as an individual authorized by you to use the programs which are installed on a single server or multiple servers, regardless of whether the individual is actively using the programs at any given time.

For the purposes of Oracle VM VirtualBox Enterprise, Named Workstation User licensing may only be applied to single-socket devices where only one named user is using Oracle VM VirtualBox Enterprise or is connecting to the virtual machines on Oracle VM VirtualBox Enterprise. A non-human operated device will be counted as a named workstation user in addition to all individuals authorized to use the programs, if such devices can access the programs. If multiplexing hardware or software (e.g., a TP monitor or a web server product) is used, this number must be measured at the multiplexing front end. Automated batching of data from computer to computer is permitted.

Socket Licensing

Oracle charges for socket licensing based on each CPU. It costs $1,000 for each socket license, and there is an annual maintenance fee of $220. Unlike some other plans, you have no minimum number of sockets to license.

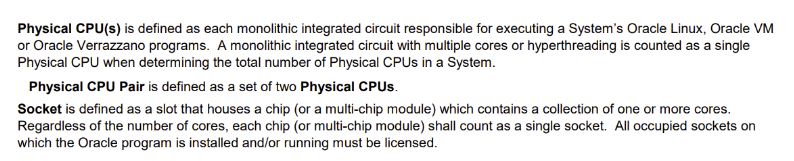

Physical CPU(s) is defined as each monolithic integrated circuit responsible for executing a System’s Oracle Linux, Oracle VM or Oracle Verrazzano programs. A monolithic integrated circuit with multiple cores or hyperthreading is counted as a single Physical CPU when determining the total number of Physical CPUs in a System.

Physical CPU Pair is defined as a set of two Physical CPUs.

Socket is defined as a slot that houses a chip (or a multi-chip module) which contains a collection of one or more cores. Regardless of the number of cores, each chip (or multi-chip module) shall count as a single socket. All occupied sockets on which the Oracle program is installed and/or running must be licensed.

Pricing Example

Continuing with the discussion, we will delve into specific examples that demonstrate how these licensing models are applied in certain scenarios and how the costs are structured.

Example 1 – An organization with 100 specific users needing access to VirtualBox

In this example, the organization would need to purchase 100 NUP licenses since that’s the minimum required. The total cost would include the license and support costs, amounting to $6,100.

Example 2 – An organization that wants to purchase 20 CPU Sockets.

These tables serve as a simplified example to demonstrate how the licensing and costs are structured for Oracle VirtualBox. When planning to purchase licenses, it’s essential to consider both the initial and ongoing support costs to understand the total expenditure over the software’s lifecycle.

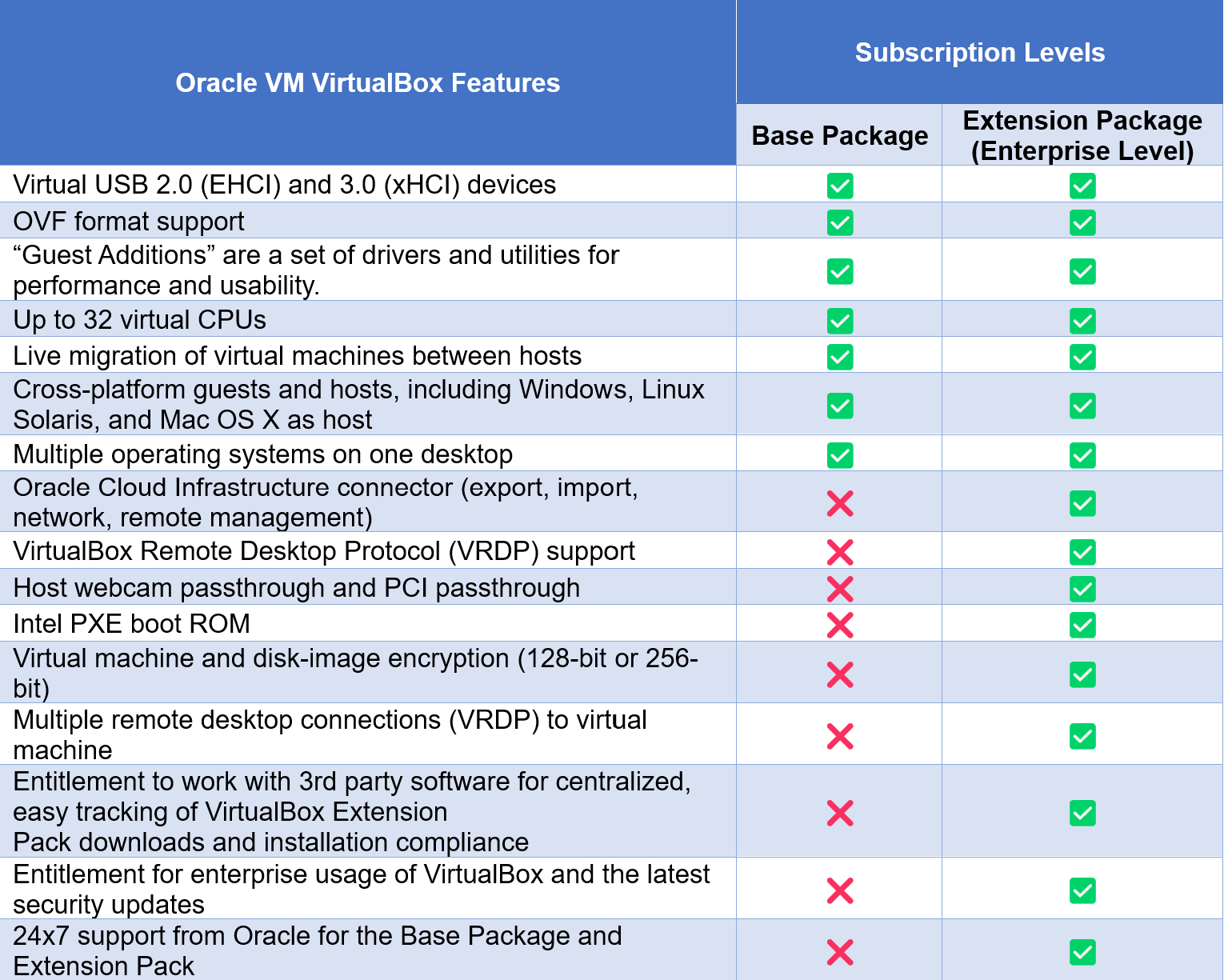

Difference Between Base and Extension Pack

The Oracle VM VirtualBox comes in two main variants:

- Base Package

- Extension Package

Specific licensing terms govern each and offer different levels of functionality.

Base Package

The Base Pack for Oracle VM VirtualBox is a free, open-source software under the GNU General Public License version 2 (GPL v2). This means you can use, examine, share, and change the software for free if you follow the license's rules. Its main features include:

Extension Package

The Extension Pack adds extra capabilities to the basic VirtualBox software. It lets you use advanced features like USB 2.0 and 3.0, remote desktop support, and disk encryption. This pack is free for personal, educational, or evaluation use only. For business purposes, you must buy a commercial license. This is the most common reason we see for Virtual Box non-compliance.

It is crucial for users and organizations to understand the difference between both variants to ensure compliance with the licensing terms and to choose the correct package based on their needs. For more specific information on the licensing terms and the features provided by each package, check the comparison table below, which summarizes both subscriptions and their features.

When Do You Need a Commercial License for Oracle VirtualBox?

Using the Basic Version:

You don't need a commercial license if you're using the basic VirtualBox package without any extra features.

Using the Extra Features (Extension Pack):

For personal use or trying it out: You don't need a commercial license if you're using the extra features just for yourself or to test them, as long as you stop after 30 days.

For schools: Teachers and students don't need a commercial license if they use the extra features as part of their schoolwork.

For business use: You must get a commercial license if you use the extra features for any business-related work, no matter if it's a company, organization, or government office.

Evaluation Period Overrun

A commercial license must be purchased if the usage exceeds the 30-day evaluation period with the Extension Pack.

Oracle VirtualBox Audit Process

Let’s summarize what you can expect from an Oracle VirtualBox Audit.

- Soft Audits: Oracle doesn’t do formal, heavy-handed GLAC audits for VirtualBox. Instead, they conduct ‘soft audits’, which are less formal and are done by the offshore Virtual Box sales team.

- Audit Initiation: Audits typically start when Oracle’s system flags downloads of the VirtualBox from your company. One of the things they track is IP address.

When Oracle Reaches Out: If you hear from Oracle about your Virtual Pack usage, it’s likely they are seeing end-user downloads and want to check if you’re compliant with their licensing.

How Did This End up in My Locked Environment: Sadly, this software is easily accessible for free download. Additionally, many developers and administrators, who usually have admin rights on computers and servers, are accustomed to using this software in their personal or academic settings. They may not be aware that while it's free for personal use, it requires a license in a commercial environment, leading them to install it. Oracle promotes this by allowing free downloads of the software, but then they monitor these downloads and pursue companies after it's installed in their systems.

- Best Next Steps: If Oracle comes knocking, it’s advisable to consult with licensing experts. Securing professional advice can save you hassle, especially if sorting through licensing isn’t your thing. They are good at guiding you through the audit and can often help wrap it up without you needing to spend more on extra licenses. In our experience, the cost of hiring professional help far outweighs the fines and drama caused by Virtual Box compliance.

The Oracle VirtualBox Sales Team are known for their proactive and assertive approach when it comes to software compliance and can be very persistent once they have contacted you. This is part of Oracle’s aggressive strategy to allow free software use before generating revenue for these products with compliance audits, especially once used in a commercial setting.

Oracle VirtualBox Licensing Compliance: What Should Customers Do?

Check for VirtualBox With an ELP: Customers should use an Effective License Position (ELP) to see if they have Oracle VirtualBox installed. This helps figure out where and how many VirtualBox, and if the Extension Pack, is installed. If you’re unsure how to do this, Licensing Data Solutions can help by showing you where VirtualBox is installed on your devices and whether it's the basic version or the paid Extension Pack. If Oracle checks this for you then they might not be willing to help fix the problems or suggest cheaper options, and could push for the most expensive commercial/contractual solution.

Figure Out What Edition You're Using: Customers need to check their systems to see if they're using just the basic VirtualBox or if they've also installed the Extension Pack. This is important because the Extension Pack has additional rules and in some cases might need a paid license.

Clean Up Your System: If you have the Extension Pack or certain VirtualBox features you're not using then consider removing them. Uninstalling software you don’t need can help avoid problems and costs related to licenses you’re not using.

Buy Licenses Before Oracle Comes Knocking: Don't wait for Oracle to audit you because you will be hit with back penalties. If you need a certain license for using VirtualBox, get it early. This helps you stay legal and avoid fines or issues caused by license problems. It's good planning to buy the licenses you need beforehand, especially if you move from using VirtualBox for personal to business purposes or if your trial period has expired.

Prevent Future Unauthorized Downloads:

To stop unauthorized downloads of VirtualBox in the future, take these steps: First, block access to these websites: https://www.virtualbox.org/wiki/Downloads and https://www.oracle.com/virtualization/technologies/vm/downloads/virtualbox-downloads.html

This will prevent downloading from these sources. Next, create a policy within your company that explains the differences between the free and paid versions of VirtualBox. This will help your staff understand what is allowed and what isn't. Also, implement controls to stop people from installing VirtualBox without the proper approval. Finally, make it a regular practice to review your software systems to make sure that VirtualBox hasn't been installed without proper permission. This will help maintain control over software use and ensure compliance with licensing rules.

FAQs: Oracle VirtualBox Licensing

Does Oracle track VirtualBox downloads?

Yes, Oracle tracks all VirtualBox downloads. If you've been contacted by them, it's highly likely that someone in your company has downloaded VirtualBox.

Is Oracle GLAC carrying out audits on VirtualBox?

No, Oracle GLAC doesn't conduct audits on Virtual Box. However, the Oracle Virtual Box sales teams make their own compliance checks aka Soft Audits, especially if they notice downloads coming from your company.

Is VirtualBox free for business use?

The basic version of VirtualBox, without the Extension Pack, is free for businesses. However, the version that includes the Extension Pack is not free for enterprise use, though it is free for personal use. Businesses need to either remove any unauthorized installations or buy the required licenses. Often, companies mistakenly believe all versions of VirtualBox are free and are surprised to discover the Extension Pack installed in their systems.

What editions of VirtualBox are available?

Currently, Oracle VM VirtualBox provides two main editions:

- Base Package: This edition is free and open source, distributed under GNU General Public License (GPL).

- Extension Package: Offers additional features and may require the purchase of commercial licenses, depending on how it is used.

What is the minimum number of Oracle VirtualBox Enterprise licenses I can purchase?

If you're going with the Named Workstation User option, you must purchase licenses for a minimum of 100 users. In the case of socket-based licensing, the least you can purchase is a license for one socket.

If I ignore the Oracle Virtual Box team, will they stop contacting me?

No, they won't. The Oracle Virtual Box sales team is known for being very persistent; we internally call them honey badgers. If you don't respond, they'll likely start contacting your colleagues and move up the chain of command and start reaching out to your executive level of management like CIO, CFO and CEO.

I've been approached by the sales team from Oracle Virtual Box, what should I do?

You should consult with an expert company like Licensing Data Solutions. They can assist you in figuring out where Virtual Box is installed, help you understand the difference between free and paid versions, optimize your use of the software, and even draft emails for you to send to the Oracle Virtual Box sales team to ensure you achieve the best outcome.

We haven't installed Oracle Virtual Box, so how did it end up in our system?

Sadly, this software is easily accessible for free download. Additionally, many developers and administrators, who usually have admin rights on computers and servers, are accustomed to using this software in their personal or academic settings. They may not be aware that while it's free for personal use, it requires a license in a commercial environment, leading them to install it. Oracle promotes this by allowing free downloads of the software, but then they monitor these downloads and pursue companies after it's installed in their systems.

Conclusion

In simple terms, Oracle's VirtualBox is a well designed mouse trap by Oracle to make money. They attract people with free and easy downloads, but then there are hidden details and fine print in the licensing that can end up costing companies money. Oracle is also aggressive in selling this, especially after it's already seeped into customers' commercial environments. To sum up this blog post, it's really important for businesses to follow the rules for using Oracle's VirtualBox. Even though VirtualBox isn't as popular as it used to be, not following its licensing rules can result in big fines. If you're not sure how to tell the difference between what's free and what's not, or if you don't understand VirtualBox's complicated licensing, you should contact Licensing Data Solutions (LDS) at This email address is being protected from spambots. You need JavaScript enabled to view it.

Please check our SAP Licensing Services

Understanding Licensing and Cost Shift from SAP Solution Manager (SolMan) to Cloud ALM (CALM)

Understanding Licensing and Cost Shift from SAP Solution Manager (SolMan) to Cloud ALM (CALM)

Demystifying IBM Cloud Pak and premier on Cloud PAK Licensing in 2026

Table of Contents

Comprehensive Guide to SAP Indirect Access and How to measure Digital Access in 2026

Introduction

In the ever-evolving world of SAP software, indirect access has become a critical consideration for businesses when it comes to licensing, and it’s even more problematic if a customer is undergoing an enhanced audit or has received a SAP indirect access query from SAP sales. SAP has also weaponized indirect access to create leverage forcing customers to move to S4/HANA or RISE/GROW. The 2017 SAP v Diageo court case highlighted the issue of indirect access and under-licensing. Diageo, the defendant, faced significant fines for not having sufficient licenses for their indirect use of SAP software.