Introduction

On November 22, 2023, Broadcom made a significant impact on the IT industry by acquiring VMware for $69 billion, one of the most substantial technology transactions to date. Immediately after the acquisition was finalized, Broadcom quickly introduced significant alterations to the licensing model by ending perpetual licensing and major changes to the partner network, including how customers interact with resellers and Broadcom, as well as changes to the product packaging and bundling. This blog will cover these changes in detail, examining their effects on you as a customer. We will also provide advice on steps you can take to safeguard yourself and minimize the impact on your budgeting and licensing strategies.

Change 1 - VMware Ends Perpetual Licenses and Introduces Subscription Licensing

On December 11, 2023, VMware, now a subsidiary of Broadcom, announced a pivotal alteration in is licensing strategy, ceasing the sale of new perpetual licenses. Henceforth, VMware software will be exclusively accessible via subscription models. To clarify this change, the subscription tmodel may be compared to renting a residence or leasing a car; the license is not owned, yet it remains usable as long as the subscription fees are continually paid. Conversely, a perpetual license resembles the outright purchase of a residence or automobile; the license is owned indefinitely, with typically only nominal maintenance fees required in subsequent years. This shift towards subscription models is a trend increasingly adopted by software companies in recent years. However, Broadcom's decision to suddenly entirely eliminate perpetual licenses and forbid any new perpetual acquisitions has been met with disappointment and dismay among customers.

Please see the link to the official announcement below:

https://news.vmware.com/company/vmware-by-broadcom-business-transformation

VMware Perpetual License Phase-Out: Implications for Existing Customers

Shock at Contract Expiration and Forced Migration:

Clients currently engaged in an Enterprise License Agreement (ELA) or possessing active maintenance agreements will not experience immediate impacts from this change. They are permitted to utilize their perpetual licenses until the conclusion of their agreement or the expiration of their maintenance period.

Upon the termination of an ELA or active maintenance agreement, clients will be ineligible to receive future maintenance for their existing licenses under the old model, necessitating a forced transition to VMware’s subscription-based offerings.

Furthermore, should there be a requirement to procure any new products not encompassed within the ELA or existing agreements during the term of an ELA, such acquisitions must be made under the newly established subscription model.

Escalating Cost at Renewal

This evolution is advantageous for customers who favor operational expenditure (Opex) for their purchases. However, it poses challenges for those who prefer capital expenditure (Capex) strategies, aiming for significant upfront investment followed by reduced operational costs, and for customers who are using VMware software without active maintenance.

Customers of VMware are likely to experience an increase in costs upon renewal. This escalation can be attributed to the potential forfeiture of their existing investment in perpetual licenses. Despite assurances from Broadcom regarding the availability of a trade-up path, it has not demonstrated cost neutrality. Additionally, customers may encounter a progressive increase in expenses over time, as the subscription model tends to be more costly in the long term.

Strategic Recommendations to Customers

Understand That the Landscape Has Changed for Good

It is imperative for customers to recognize that the acquisition of VMware by Broadcom has fundamentally altered the operational landscape. The prevailing paradigms have undergone a significant shift, rendering the former status quo with VMware untenable. Clients must initiate their preparatory measures promptly, adopting a strategic approach akin to that utilized in negotiations with Microsoft or Oracle.

Understand Usage and Simulate Cost and Quantity Under the New Subscription Model

Carry out a detailed review of your current usage against what you have purchased. This evaluation, called the Enterprise License Position, gives a clear picture of how you are using VMware resources compared to what you have bought. It helps in understanding your current usage, as well as estimating future usage, if you switch to a subscription model. Based on this assessment, it is advisable for customers to adjust their deployments to prevent an unexpected rise in costs.

Change 2 - Broadcom Major Changes to the Reseller/Partner Network

Furthermore, alongside the transition from perpetual licensing to subscription-based models, Broadcom has implemented substantial modifications to its partner/reseller network. These changes could significantly alter your interactions with VMware.

Broadcom's Strategic Shift in Eliminating Resellers for Strategic Accounts: Broadcom has initiated a notable strategic shift by opting to directly oversee its major VMware accounts (2000 as per unofficial estimates), diverging from its prior approach. This repositions partners, who played a crucial role in the management of these accounts, to a sidelined status. Broadcom is now designating substantial accounts as Strategic Accounts, and will engage with them directly. Consequently, entities recognized as Strategic Accounts will no longer have the liberty to procure through their resellers, but will instead be obligated to conduct transactions directly with Broadcom.

Narrowing of Reseller Network: Broadcom has decided to reduce the number of its resellers, especially eliminating small ones. This change will greatly affect smaller businesses because they will no longer be able to sell Broadcom products through their current reseller. They will need to find and work with a larger reseller instead.

Consequences of Partner Alterations for Customers:

Direct Interaction With Broadcom and Increase in Cost: Broadcom is making changes that will reduce the support and incentives previously provided by resellers, especially for large or strategic accounts. This means that instead of receiving personalized support from resellers, these accounts will have to deal directly with Broadcom. This shift could result in the loss of discounts due to Broadcom's tough negotiating stance. Moreover, without a reseller acting as an intermediary, there's a higher chance of audits. If Broadcom's sales staff finds the terms of a deal unsatisfactory or decides to examine an account closely, they may be more likely to nominate the customer for a software licensing audit.

For smaller customers, this adjustment will likely lead to increased costs, as they will now need to engage with larger resellers. These bigger entities may not place as much emphasis on their relationship or exert the same effort to secure discounts that smaller resellers previously managed to obtain.

Guidance for Customers on How to Navigate This Reseller Change:

For small customers, verify whether your current reseller remains within the Broadcom network. If not, initiate efforts to build connections with a reputable reseller.

For large customers, prepare for direct negotiations with Broadcom. Begin preparations for VMware/Broadcom discussions several months prior to your contract's expiration. Consider enlisting third-party assistance, such as LDS, which can aid in comprehending the alterations, educating your internal management, analyzing your current and future consumption and costs, benchmarking these costs, and facilitating negotiation and adaptation to this new standard.

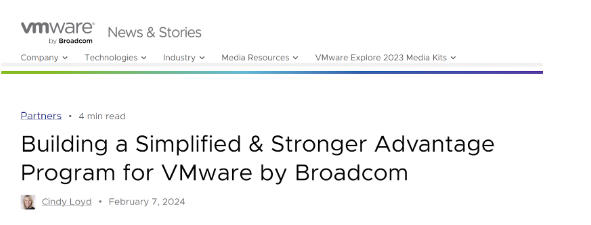

Change 3 - VMware Draconian Product Packaging/Bundling Changes!

In conjunction with the transition from perpetual licensing to subscription models and the consolidation of resellers and partners, a significant simplification and consolidation in product packaging was also unveiled. The array of stock-keeping units (SKUs) has been streamlined, resulting in the reduction to four primary SKUs: 1) VMware Cloud Foundation, 2) VMware vSphere Foundation, 3) VMware Standard, and 4) VMware Essentials.

Let’s delve into the landscape of VMware’s product offerings:

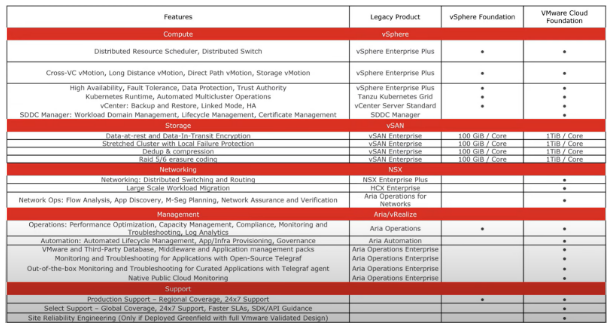

- VMware Cloud Foundation (VCF):

- vSphere Enterprise Plus

- vSAN Enterprise (1TiB per core) Not to be confused with TB (TeraByte) which is a different metric

- Tanzu Kubernetes Grid

- SDDC Manager

- HCX Enterprise

- NSX Enterprise Plus

- Aria Operations

- Aria Automation

- Aria Operations Enterprise

- Select Support

- Site Reliability Engineering

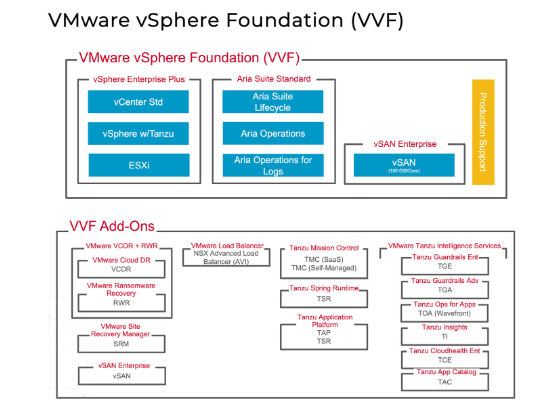

- VMware vSphere Foundation (VVF):

- vSphere Enterprise Plus

- vSAN Enterprise (100 GiB per core) Not to be confused with GegaByte GB

- Tanzu Kubernetes Grid

- Aria Operations

Feature difference between VCF and VVF

- vSphere Standard

- vSphere Standard

- vCenter Standard

- vSphere Essential Plus Kit

- vSphere Essentials

- vCenter Essentials Plus

- Limitations

- Maximum of 3 hosts w/up to 96 Cores

Perspectives on the Recent Packaging Changes:

- This transformation is favorable for individuals fully committed to utilizing VMware; however, it poses disadvantages for customers who do not employ the complete suite of products, such as Aria/NSX.

- The implementation of product bundling is anticipated to lead to a price augmentation ranging from two to five times for all customers, attributable to the financial implications of acquiring these bundles.

- The bundling strategy is likely to culminate in the underutilization of software, resulting in resources being expended on unused software.

- VMware aims to incentivize customers to adopt more products from its suite, potentially altering bundle offerings or introducing premium versions of these products in the future to extract additional revenue from clients.

LDS Recommendations in Handling This Product Bundling

Comprehend Actual Utilization and Project Future Consumption: Clients are encouraged to ascertain both their present and anticipated future utilization at the SKU level, and to conduct a comparative analysis of current versus future costs. Leveraging this analysis, customers should negotiate discounts with VMware/Broadcom.

Elevate This Matter to the Level of Executive Management: VMware renewal is no longer a task the infrastructure team can manage on its own. Comprehending the alterations and devising either a temporary or prolonged strategy now requires the attention and decision-making of either the Chief Information Officer (CIO) or another high-ranking executive.

Investigate Substitute Strategies: It is advisable to examine other virtualization solutions that may present a more economical option, especially those characterized by stable pricing structures and negligible concealed expenses. Furthermore, it is anticipated that the future will be marked by escalating prices, a decline in development and customer support, intensified sales representative tactics, and rigorous software compliance audits.

In discussions with our clientele, the following alternatives have been mentioned:

- Transitioning to cloud services such as Azure, AWS, or GCP

- Exploring Microsoft Hyper-V

- Evaluating Nautanix

- Exploring Verge.io

- Investigating Proxmox

- Transitioning to Physical Servers

Engage in Strategic Negotiations: Upon subscription renewal, it is advisable to enter into assertive negotiations with VMware to uncover possible concessions. Benchmark your agreement to ascertain the standard discounts currently provided by Broadcom and recognize the shift in dynamics as you are now interacting with a representative from Broadcom, rather than the familiar VMware representative.

Conclusion

In summary, Broadcom has implemented significant alterations to VMware's packaging, licensing model, and reseller network. These changes are poised to deeply affect your association with VMware. It is advisable for clients to recognize that the operating framework has fundamentally transformed and to take the necessary measures to comprehend their usage, and to prepare for extensive and forceful negotiations with VMware. Additionally, it is imperative for this matter to be escalated to the level of Chief Information Officer (CIO) and to devise a strategy for assessing alternative Hypervisor Technologies. Should there be a lack of expertise internally, or a requirement for an external consultant to provide enlightenment on these modifications, assess your actual usage, project your future VMware cost, and explore alternative options, then please do not hesitate to contact Mark Thaver at This email address is being protected from spambots. You need JavaScript enabled to view it..

Please check our VMware Licensing Services